What is KSeF?

KSeF, i.e. National e-Invoice System, is the Ministry of Finance's ICT system for issuing, receiving, sending and storing invoices in a standardised electronic format (XML). Each invoice sent to KSeF receives unique identification numberand its sending to the system means that it has been officially issued.

KSeF is a major step towards the digitalisation and automation of document workflows. Thanks to it, entrepreneurs will no longer have to send invoices by e-mail or store them themselves - all documents will be available in the system by 10 years.

How does the KSeF work?

Instead of a traditional PDF or paper invoice, the trader issues a document in XML format compliant with the specified FA(3) structure.

The accounting system (e.g. mobile-calendar) sends it to KSeF via a secure API.

The invoice is given a KSeF number and goes to the central database of the Ministry of Finance, where it can be retrieved by the recipient.

This solution eliminates formal errors, speeds up the invoicing process, facilitates accounting settlements and avoids duplicate documents.

From when will KSeF be compulsory?

The Ministry of Finance has announced that the KSeF will be introduced in stages - so that companies have time to prepare:

- as of 1 February 2026. - obligation for large companies, i.e. companies with gross sales in 2024 exceeding PLN 200 million,

- as of 1 April 2026. - obligation for other taxpayersincluding small and medium-sized companies and sole proprietorships,

- from 1 January 2027 - obligation for the smallest digitally excluded entities, e.g. with a very low monthly turnover.

During the transition period, there will be time for systems adaptation and integration testing, as well as a more lenient approach to any formal errors.

What does KSeF change in practice?

Thanks to KSeF:

- all invoices go into a single, secure register,

- the need to manually send invoices by e-mail will disappear,

- counterparties have immediate access to issued documents,

- the tax administration automatically verifies the data and correctness of the invoices,

- taxpayers gain full archiving of documents in the public cloud.

It also makes things easier for accounting offices and accounting departments - data can be automatically imported and processed in financial systems.

How the invoice module in mobile-calendar works

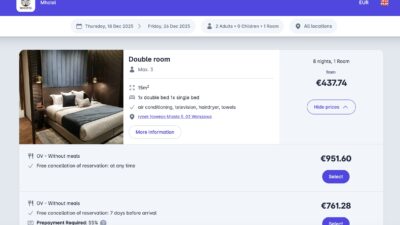

W mobile-calendar an expanded invoice modulewhich enables the issuing and sending of sales documents directly from the system. It was designed for hotel, guesthouse and flat owners who want to issue invoices simply and quickly - without the need for external accounting software.

The most important functions of the invoice module in mobile-calendar are:

- issuing sales invoices linked to bookings in the calendar,

- sending an invoice by e-mail to a visitor or contractor directly from the system,

- archiving of all documents in one place - every invoice issued is saved in your panel,

- possibility to filter and download reportswhich facilitates cooperation with accounting.

mobile-calendar + KSeF - what are we planning?

We are working towards a full integration with the National e-Invoice System.

Once the obligation is implemented, the invoice module in mobile-calendar will automatically:

- sent the issued invoices to KSeF,

- received the invoice identification number at KSeF,

- informed about the status of the document (e.g. accepted, rejected, in queue),

- ensure full compliance with the current structure and requirements of the Ministry of Finance.

As a result, mobile-calendar users will not have to change their habits or install additional tools - everything will take place directly in the system, in a module they are already familiar with.

Summary

KSeF is the biggest change to the invoicing system in years - but it is also a huge opportunity to clean up and simplify processes.

With the mobile-calendar integration in the pipeline, users will be able to issue and send KSeF-compliant invoices without additional paperwork, in the same intuitive environment they use every day.

The mobile-calendar team is already working on this. Once the KSeF system is in place - the we will be ready.

Sources:

- Ministry of Finance - ksef.podatki.gov.pl

- enova.co.uk - "KSeF from when and for whom?"

- ifirma.co.uk - "KSeF 2026: key dates"

- pit.co.uk - "KSeF without penalties in first year of operation"

- jpk.info.pl - "Structured e-invoice - KSeF principles".