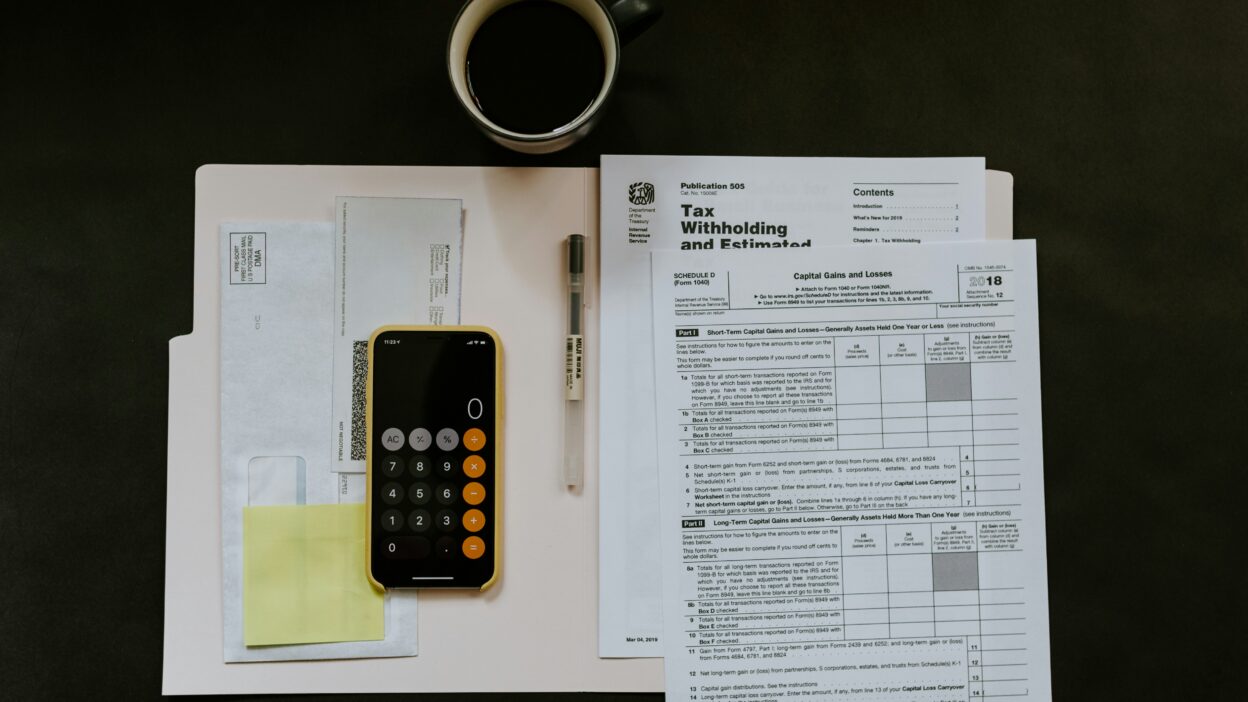

In the hospitality industry, one of the often overlooked yet mandatory elements of guest service is the local tax, also known as the sojourn tax, spa tax or local tax. It is a charge levied on guests by the owners of accommodation facilities and remitted to the relevant local authorities.

Why is this important?

The amount and rules for charging this tax vary from location to location, with some municipalities having a daily rate, others a percentage rate, and still others charging it only from the second or third day of stay. Regardless of the form, its correct charging and reporting is an obligation on every operator in the accommodation sector.

And while this may seem like a minor formality, in practice, inaccuracies in documentation can lead to serious consequences - from administrative fines to problems during inspections

W mobile-calendar you can configure and report local tax.

What can you do?

🔧 Set a quota or percentage fee - tailored to local regulations.

👨👩👧👦 Differentiate between adult and child rates - if required by law.

📅 Specify on which day of stay the tax is charged - e.g. from day two.

📊 Generate readable .csv reports - filterable by dates, guests and bookings.

Get full control over local tax settlements - no extra work and no mistakes.