Top 5 countries + OTAs to work with

In 2025, tourism in Poland is not only returning to its pre-pandemic strength, but is starting to break new records. Figures from the Central Statistical Office show that in the first quarter of 2025, more than 8 million tourists will be accommodated in Polish accommodation facilitieswho generated 19.1 million overnight stays - an increase of 12.9% and 9.6% respectively compared to 2024.

Growing traffic is good news for the industry as a whole - but the key question is: Where do tourists come from and how do we reach them in order to increase occupancy rates even in the low season?

The following is an analysis top 5 countries from which visitors come most often to Poland, and OTAs (Online Travel Agencies)which are most important to them. These are practical tips for hotel, guesthouse, flat and agritourism owners who also want to fill their calendar during the autumn and winter months.

🇩🇪 1. Germany - permanent leader among foreign tourists

For years, tourists from Germany have been the largest group of visitors to Poland. In the first quarter of 2025, there were more than 312,000 of them.

They most often choose Pomerania, Masuria and Krakow, but they are also increasingly interested in lesser-known regions that offer tranquillity and authenticity.

Why should they be courted?

➡ Germans are keen to travel by car and often choose short stays (weekend or 3-4 days) even in the low season.

➡ They appreciate the good service, cleanliness and clear booking rules.

Popular OTAs in Germany:

- Booking.com - approx. 72% OTA market share

- Expedia - often used by tourists looking for flight + hotel packages

- HolidayCheck - popular review and booking platform

- Weg.de, Check24 Reisen - local tourist portals with a developed accommodation segment

💡 Tip: Ensure a full description and reviews in German - this significantly increases conversions during periods with less traffic.

🇨🇿 2. Czech Republic - a new growth direction

Czechs are increasingly visiting Poland - not only the Tatra Mountains, but also the Polish coast.

According to Le Monde, the number of Czech tourists at the Baltic Sea is increasing year on year.

Why is it worth it?

➡ Proximity and easy access - Czechs travel by car, often for short weekends.

➡ They are loyal - if the stay meets expectations, they return in subsequent seasons.

➡ This is a market with great potential in autumn and winter (city break, wellness, culinary).

Most commonly used OTAs:

- Invia.cz - the largest Czech booking platform (more than 1 million users)

- Booking.com - main international booking channel

- Slevomat.cz - popular hotel package portal

💡 Tip: Add a description of the object and packages in Czech or English. For Czechs, it is simplicity, pictures and a clear offer that counts - e.g. "Weekend for two" or "Relaxation with wellness".

🇬🇧 3. UK - a stable, valuable market

In 2025. Poland has already been visited by more than 170,000 tourists from the UK.

Brits are returning to Polish cities, but they are also increasingly looking for peace and authentic experiences in smaller towns and cities.

Why is it worth it?

➡ It is a market with high purchasing power.

➡ They are open to travel all year round - even in autumn and winter.

➡ They value good communication in English and an easy online booking process.

Popular OTAs:

- Booking.com i Expedia - market leaders

- Lastminute.com - British service with a growing share of hotels in Central Europe

- Hotels.com, Agoda, TravelRepublic

💡 Tip: It is advisable to use English package titles (e.g. 'Autumn Escape', 'Winter Getaway') - even if booking through a Polish OTA profile.

🇳🇱 4. Netherlands / Benelux - a small but profitable market

Tourists from the Netherlands and Belgium are increasingly choosing Poland as a 'slow travel' destination.

They are looking for nature, tranquillity, good food and authenticity.

Why is it worth it?

➡ Affluent market, willing to stay longer (5-7 days).

➡ They mainly travel in spring and autumn.

➡ They are active online and are happy to book through OTAs.

Most commonly used OTAs:

- Booking.com (Dutch brand - the strongest in the region)

- Expedia i TUI.nl - for package travel

- Belvilla, Voordeeluitjes.nl - portals specialising in holidays in rural regions

💡 Tip: The Dutch often plan ahead. Communication about availability and 'early booking' discounts for the next season works well.

🌏 5. Gulf countries and Scandinavia - a niche but dynamic trend

More and more guests from Saudi Arabia, the United Arab Emirates or Norway are visiting Poland. "The Times" notes that in Zakopane, the share of visitors from the Gulf country has already reached 30%.

Why is it worth it?

➡ These are premium guests, often travelling with families.

➡ They are looking for privacy, quality and additional services (transfers, wellness, halal cuisine).

➡ They travel at times when the season is winding down in Poland - i.e. the ideal segment for autumn and winter.

OTAs and channels:

- Booking.com - most selected globally

- Expedia, Agoda, Trip.com - for international customers

- WeGo, HolidayMe, Rehlat - popular platforms in the Gulf Cooperation Council (GCC) region

💡 Tip: Ensure descriptions and photos are in English, emphasising peace, safety and comfort.

📈 How to use this data in practice

Regardless of the size of the facility, a few measures can realistically increase occupancy during the so-called 'dead season':

- Customise the languages of your offer - English and German at a minimum, but if you are targeting the Czech Republic, it is worth adding a description in Czech.

- Activate seasonal offers in the OTA - e.g. 'Autumn Sale', 'Long Stay Discount', 'Winter Getaway'.

- Create packages and messages for specific markets - For Germans: tranquillity and comfort; for Czechs: wellness and weekends; for Brits: nature and climate; for Dutch: slow travel; for Bay Area visitors: privacy and luxury.

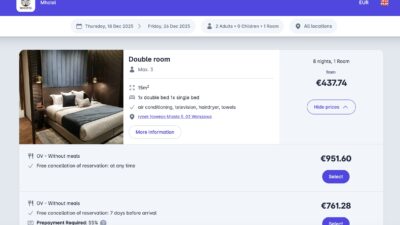

- Measure the effectiveness of channels - check in mobile-calendar which source and country the bookings are coming from; this will optimise OTA commission costs.

- Maintain high data quality in OTA profiles - complete photos, up-to-date descriptions, feedback responses - this raises visibility in the platforms' algorithms.

💡 Summary

In 2025, Poland is attracting an increasingly diverse range of tourists.

Most visitors come from: Germany, the Czech Republic, the United Kingdom, the Netherlands and the Gulf/Scandinavian countries.

Each of these markets uses different OTA channels and has different expectations, but they all have one thing in common. growing interest in Poland also outside the summer season.

For accommodation facilities, this is the ideal time to:

- update profiles on OTAs,

- launch multilingual offers,

- use mobile-calendar to analyse traffic sources and synchronise multiple portals in one clear calendar.

👉 Ensure international visibility - combining data, trends and active OTAs is the easiest way to have a more complete booking calendar throughout the year. With Channel Manager In mobile-calendar, you can synchronise multiple calendars and booking systems in one place, avoiding double bookings and saving time on manual availability management.

📚 Sources

- Central Statistical Office - Occupancy of tourist accommodation establishments, Q1 2025

- TVP World - Poland sees 13% surge in tourist numbers in early 2025

- Le Monde - Poland is attracting foreign tourists on a quest for a cool summer escape (2025)

- Horwath HTL - Between Visibility and Independence: Hotel Distribution Trends 2024

- WhiteSky Hospitality - Top Online Travel Agencies in Europe 2024

- The Times - Polish hills breathe fresh Middle East tourism (2025)

- WTTC - Travel & Tourism in Poland set to surpass economic records (2025)